India, Jan. 7 -- Access quick funds with competitive interest rates, simple documentation, and a chance to win exciting rewards during the Gold Loan Carnival

07 January 2026 Gold has always held a special place in Indian households, valued not only as jewellery but also as a dependable financial asset. In recent years, gold loans have emerged as a practical solution for managing planned and unplanned expenses without selling cherished jewellery. With the launch of its Gold Loan Carnival, Bajaj Finance is bringing renewed focus to informed borrowing by simplifying the process and rewarding customers who use gold loans wisely.

The Bajaj Finserv Gold Loan offers a smooth and quick application experience, allowing customers to unlock the value of their gold jewellery with minimal effort. By combining competitive interest rates, fast approvals, and festive rewards, the Gold Loan Carnival positions gold loans as a timely and responsible financial choice during the offer period from 25 November 2025 to 28 February 2026.

What is the Gold Loan Carnival?

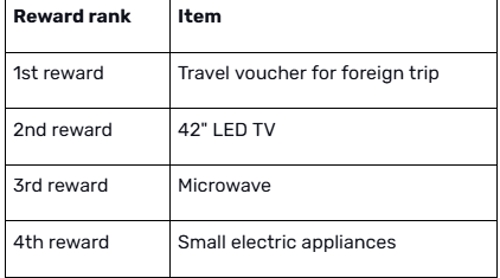

The Gold Loan Carnival is a limited-period reward programme introduced by Bajaj Finance for customers who avail and receive disbursal of a gold loan during the offer window. Eligible participants who meet the defined criteria stand a chance to win attractive rewards, as outlined below:

Eligibility criteria for the Gold Loan Carnival

To apply for a gold loan, customers must meet the following requirements:

● Be an Indian citizen aged between 21 and 80 years

● Pledge gold jewellery with a purity of 18 to 22 karat

● Submit the documents required for gold loan as per Bajaj Finance guidelines

Additional conditions to qualify for Gold Loan Carnival rewards

● The gold loan amount must be Rs. 1,00,000 or more

● The loan must remain active for a minimum of 180 days from the date of disbursal

● Each customer is eligible to receive the reward only once during the offer period

Key documents needed for quick gold loan approval

Bajaj Finance keeps the gold loan process simple with minimal documentation, helping customers complete the pledge quickly and without delays. Applicants need to carry any one valid identity proof from the list below:

● Aadhaar card

● Voter ID card

● Passport

● Driving licence

● NREGA job card

● Letter issued by the National Population Register

For gold loan amounts of Rs. 5 lakh or above, submission of a PAN card is mandatory.

Keeping the required gold loan documents ready helps speed up verification and disbursal. Many customers are able to complete the entire process in a single branch visit when they arrive fully prepared.

Rate of interest against gold loan supports informed financial planning

The rate of interest against gold loan plays an important role in helping borrowers manage repayments comfortably. Since gold loans are secured, they usually carry lower interest rates compared to unsecured loans. Bajaj Finance offers competitive interest rates, making gold loans an affordable borrowing option.

The final interest rate depends on factors such as gold purity, loan tenure, loan amount, and market gold prices as per IBJA. This transparent approach allows customers to align their borrowing decisions with their financial goals. Awareness of gold rates also helps customers estimate loan eligibility more accurately.

The Bajaj Finserv Gold Loan provides multiple repayment options, secure storage of pledged jewellery, and clear loan terms. These features help borrowers maintain control over their finances while preserving ownership of their gold.

Steps to apply for a Bajaj Finserv Gold Loan

● Visit the Bajaj Finserv App or website

● Find the gold loan page and click on “Apply”

● Enter the registered mobile number and verify using OTP

● Fill in personal details and select the nearest branch

● Download the in-principal loan eligibility letter

Once done, their representative will contact the applicant about the further process.

Gold loan carnival reinforces gold loans as a smart financial choice

Gold loans continue to gain relevance as a wise financial option against gold, especially during times when quick liquidity is essential. By simplifying documentation, offering competitive interest rates, and introducing the Gold Loan Carnival, Bajaj Finance encourages customers to make informed and timely financial decisions.

The Bajaj Finserv Gold Loan stands out as a reliable solution that blends speed, transparency, and festive rewards. As customers become more aware of gold rates, documentation requirements, and loan features, gold loans are set to remain a preferred choice for meeting financial needs with confidence.

T&C Apply

About Bajaj Finance Limited

Bajaj Finance Ltd. (‘BFL’, ‘Bajaj Finance’, or ‘the Company’), a subsidiary of Bajaj Finserv Ltd., is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC). BFL is engaged in the business of lending and acceptance of deposits. It has a diversified lending portfolio across retail, SMEs, and commercial customers with significant presence in both urban and rural India. It accepts public and corporate deposits and offers a variety of financial services products to its customers. BFL, a thirty-five-year-old enterprise, has now become a leading player in the NBFC sector in India and on a consolidated basis, it has a franchise of 80.41 million customers. Bajaj Finance has a credit rating of AAA/Stable for its Fixed Deposit program from CRISIL and ICRA, AAA/Stable for long-term borrowing from CRISIL, India Ratings, CARE and ICRA, and A1+ for short-term borrowing from CRISIL, India Ratings and ICRA. It has a long-term issuer credit rating of BBB-/Stable and a short-term rating of A3 by S&P Global ratings. To know more, visit www.bajajfinserv.in.

Want to get your story featured as above? click here!

Disclaimer: This is a Press Release distributed by HT Syndication. For queries write to contentservices@htdigital.in